Pocketsmith

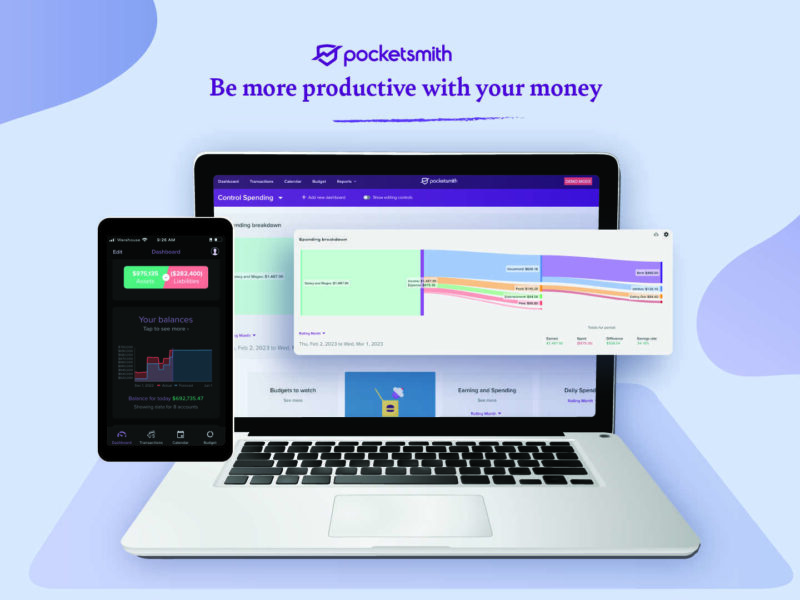

Pocketsmith Budgeting Software

There are a number of features that I like which make Pocketsmith easier and therefore more efficient than most types of budgeting systems.

Flexible Budgeting – you can break down your budget into specific expenses, expense categories or time frames and this makes it easier to review things.

Looking Back – when you start you can upload bank data for the previous 3-months which is great as it gives you an instant snapshot of what you have been spending – you cannot hide from that! Most budgets and budgeting software starts from the day that you set it up and therefore you do not really get a real picture of your spending habits.

Automatic Bank Feeds – on the Basic version you manually upload the transactions from your online banking; however if you upgrade to the Premium version this is all automatic and that means it’s easier and kept up to date.

Mobile App – yes, there is a mobile App too. Most people now prefer mobile App’s as it makes it easier to keep track of things.

Training Guides – there are plenty of training guides on the website to help you every step of the way.

If you are serious about managing your money then you should get Pocketsmith.

Location

Reviews

“PocketSmith allows me to take all the information I have in my head about upcoming big expenditures and pop it into my PocketSmith calendar. I can see the impact ahead of time and adjust accordingly. It relieves all my anxiety about missing payments or not knowing whether I will have enough cash on hand if an emergency comes up.

“PocketSmith ticked all the boxes for our needs. It was just perfect, easy, and really intuitive. Out of the box, I was able to connect to my bank feeds, categorize my spending, and set up budgets within an hour or two. Once the basics were done, I was able to really drill down into the detail and get things fine-tuned.”